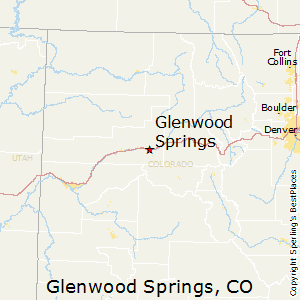

glenwood springs colorado sales tax rate

Click here for a larger sales tax map or here for a sales tax table. Future job growth over the next ten years is predicted to be 405 which is higher than the US average of 335.

Colorado has state sales tax of 29 and allows local governments to collect a local option sales tax of up to 8There are a total of 276 local tax jurisdictions across the state collecting an average local tax of 4075.

. Glenwood Springs CO Sales Tax Rate. The Glenwood Springs sales tax rate is 37. This is the total of state county and city sales tax rates.

You can find more tax rates and allowances for Glenwood Springs and Colorado in. Taxes in Glenwood Springs Colorado are 73 more expensive than Colorado Springs Colorado. City Hall 101 W 8th Street Glenwood Springs CO 81601 Phone.

Sales Tax Online Services. Effective January 1 2021 the City of Colorado Springs sales and use tax rate has decreased from 312 to 307 for all transactions occurring on or after that date. - The Sales Tax Rate for Glenwood Springs is 86.

The minimum combined 2022 sales tax rate for Colorado Springs Colorado is. Golden CO Sales Tax Rate. - The Income Tax Rate for Glenwood Springs is 46.

The Colorado sales tax rate is currently 29. Grand Junction CO Sales Tax Rate. If your business is located in a self-collected jurisdiction you must apply for a.

Learn about sales tax rates sales tax returns and more. The minimum combined 2022 sales tax rate for Glenwood Springs Colorado is 86. The Colorado Springs sales tax rate is.

Address Phone Number and Fax Number for Garfield County Treasurers Office a Treasurer Tax Collector Office at 8th Street Glenwood Springs CO. Granada CO Sales Tax Rate. Glenwood Springs in Colorado has a tax rate of 86 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Glenwood Springs totaling 57.

MUNIRevs allows you to manage your municipal taxes licensing 24x7. Grand County CO Sales Tax Rate. Auto Sales Tax amortized over 6 years Yearly Property Tax.

Glenwood Springs limits 001 000 RTA Regional Transportation Authority Roaring Fork Aspen and Snowmass Village city limits unincorporated Pitkin County 000 000 RTA Regional Transportation Roaring Fork Areas of unincorporated 001 000 Page 11 of 22 04182022 Use Tax Rates for Districts in Colorado. 1 day agoMany locals still recall the last time an ill-advised annexation was attempted and soundly rejected by Glenwood Springs residents. To begin please register or login below.

Home is a 2 bed 20 bath property. 6 rows The Glenwood Springs Colorado sales tax is 860 consisting of 290 Colorado state. What is the sales tax rate in Glenwood Springs Colorado.

It also contains contact information for all self-collected jurisdictions. Sales Taxes Amount Rate Colorado Springs CO. This is the total of state county and city sales tax rates.

Gold Hill CO Sales Tax Rate. The combined amount is 820 broken out as follows. 1281-129 County Rd Glenwood Springs CO 81601 is a single-family home listed for-sale at 650000.

If you need assistance see the FAQ. Name Garfield County Treasurers Office Address 109 8th Street Glenwood Springs Colorado. 4 rows Glenwood Springs CO Sales Tax Rate The current total local sales tax rate in Glenwood.

Gleneagle CO Sales Tax Rate. Current City Sales Use Tax Rate. The Colorado sales tax rate is currently.

Sales tax rate in Glenwood Springs Colorado is 8600. Based on Glenwood Springs general sales tax rate of 37 the nearly 89 million in sales taxes generated through mid-year equates to 2397 million in. Granby CO Sales Tax Rate.

Goldfield CO Sales Tax Rate. The US average is 73. One of a suite of free online calculators provided by the team at iCalculator.

View more property details sales history and Zestimate data on Zillow. This document lists the sales and use tax rates for all Colorado cities counties and special districts. Combined with the state sales tax the highest sales tax rate in Colorado is 112 in the cities.

Tax Rates for Glenwood Springs. The 86 sales tax rate in Glenwood Springs consists of 29 Colorado state sales. Arguments for 480 Donegan could be mistaken for the echoes of the failed annexation of the 149-lot Red Feather Ridge development proposal in 2003But just like 2003 the alternative to annexation is better.

307 City of Colorado Springs self-collected 200 General Fund. The Glenwood Springs Colorado Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Glenwood Springs Colorado in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Glenwood Springs Colorado. The County sales tax rate is 1.

The County sales tax rate is.

Economy In Glenwood Springs Colorado

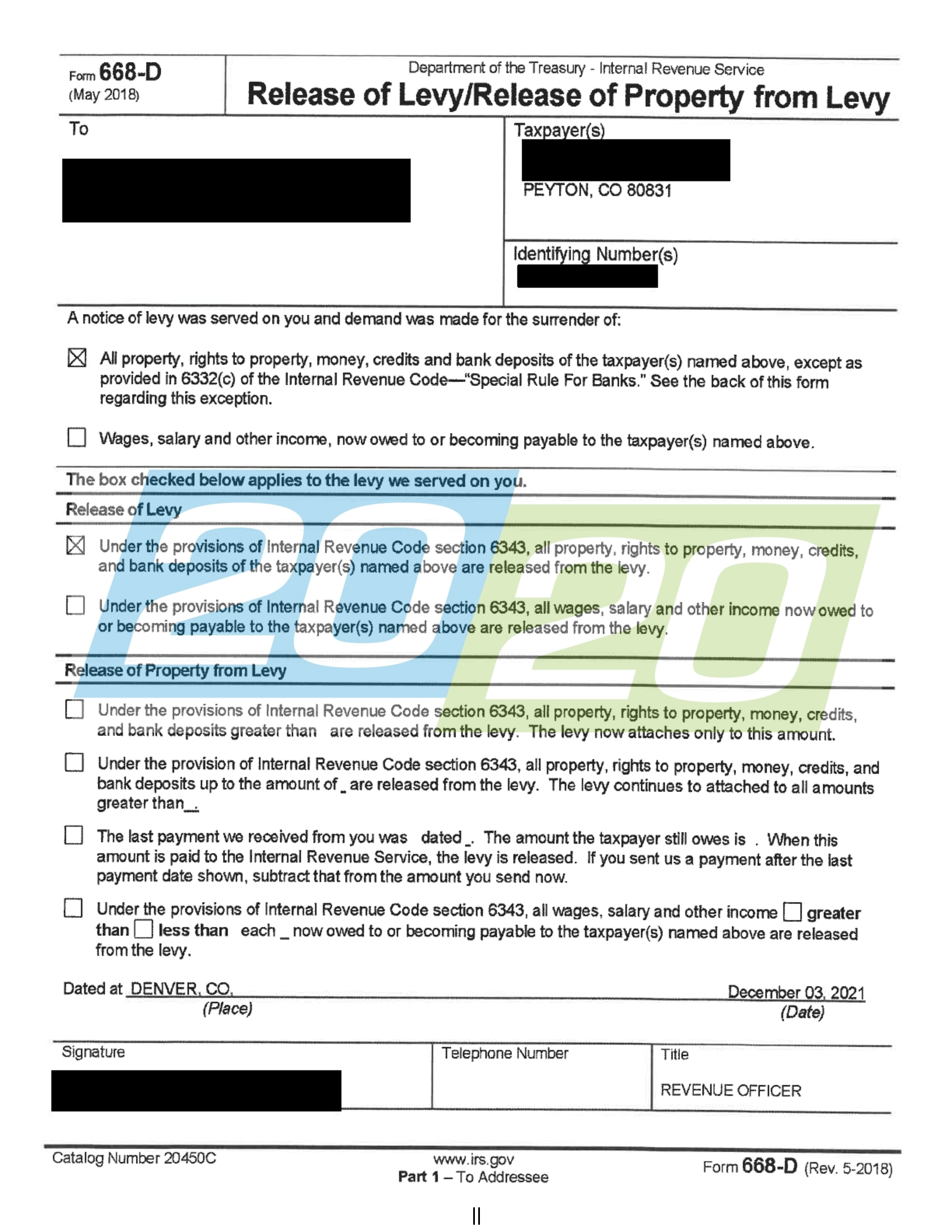

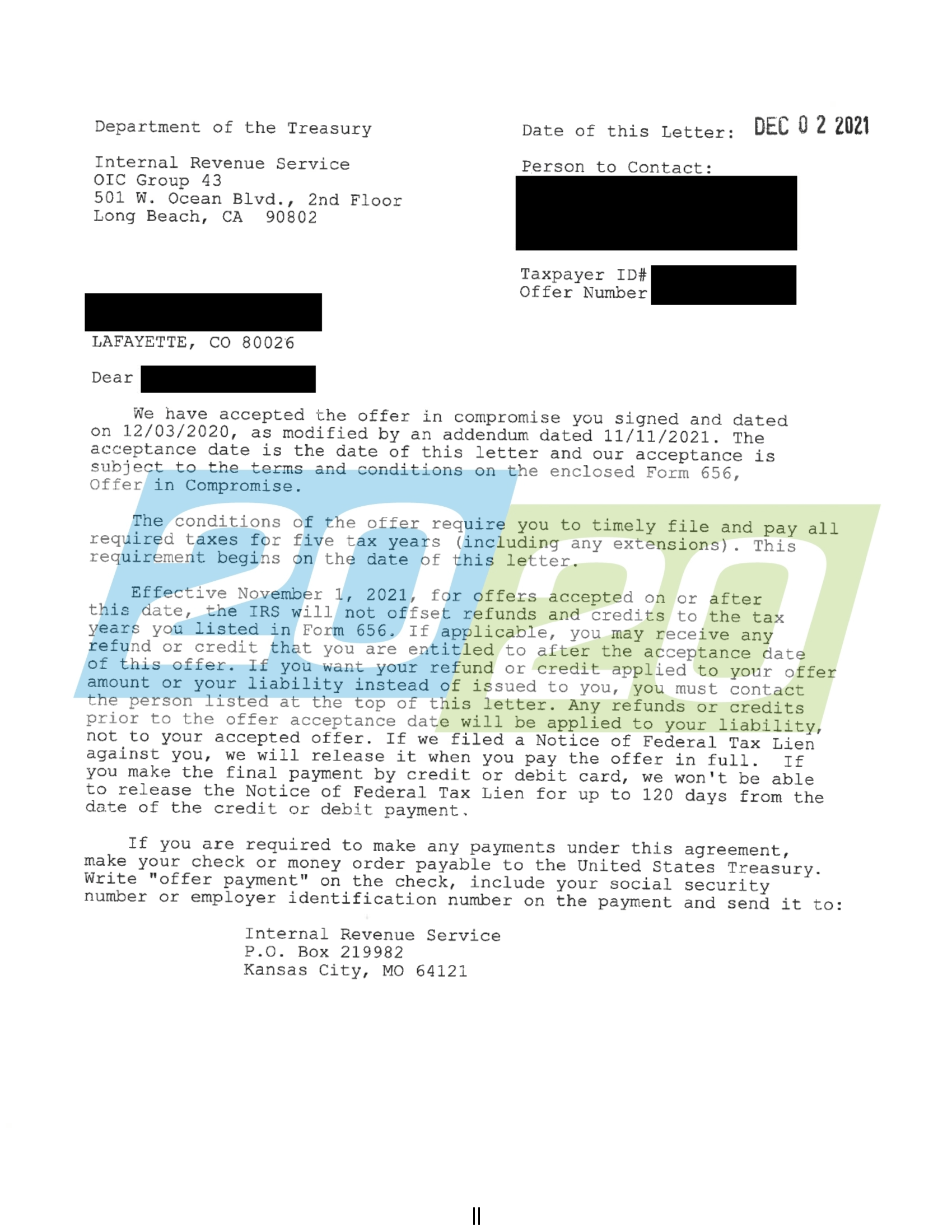

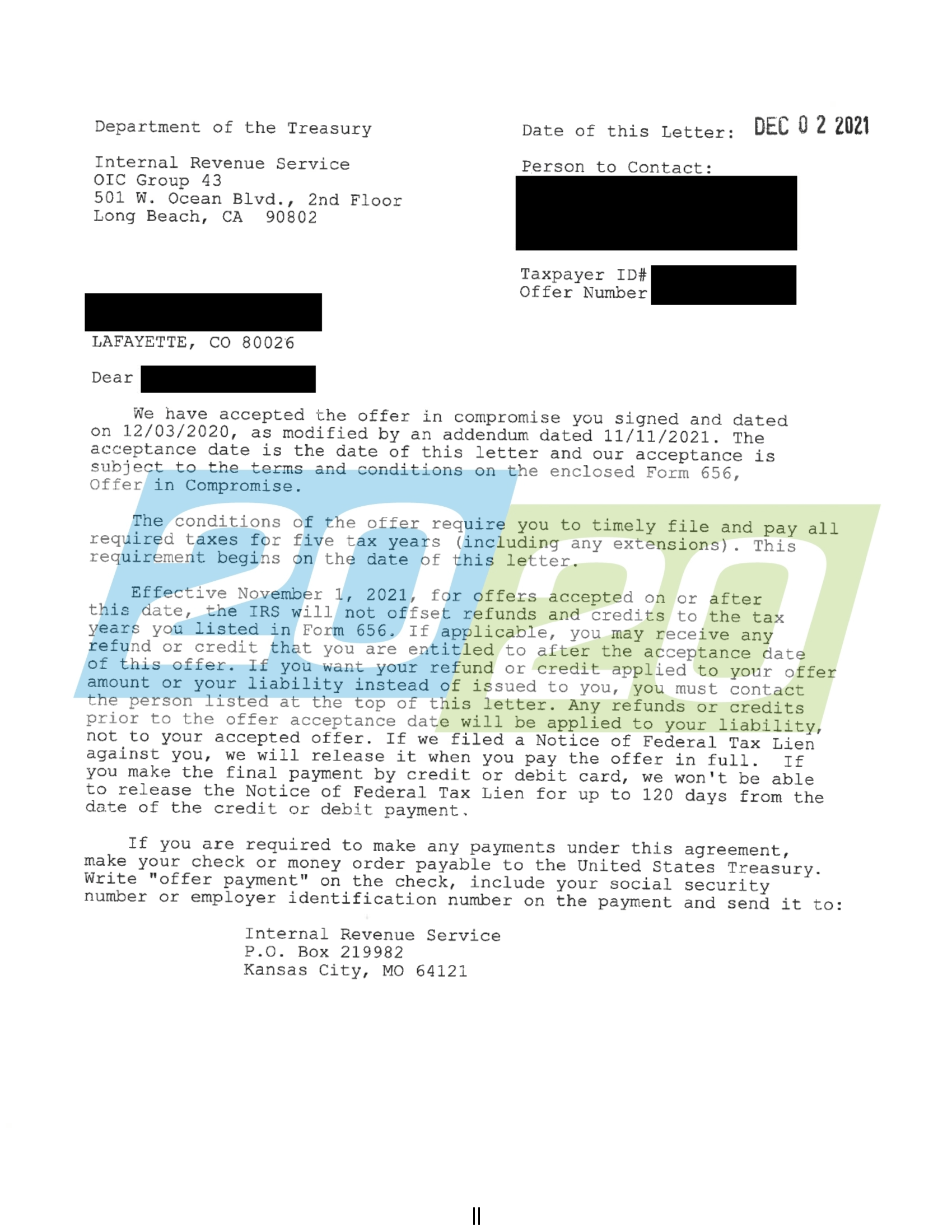

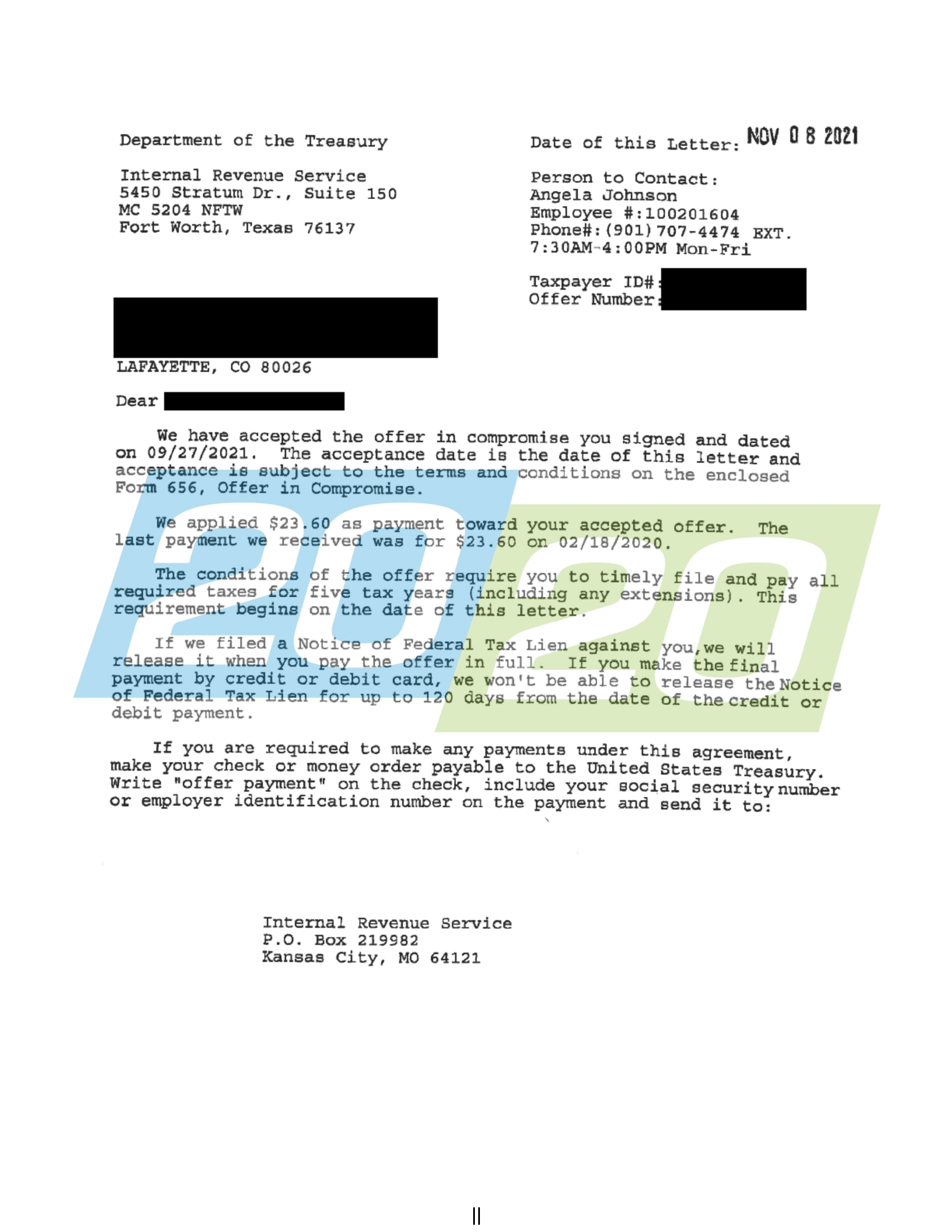

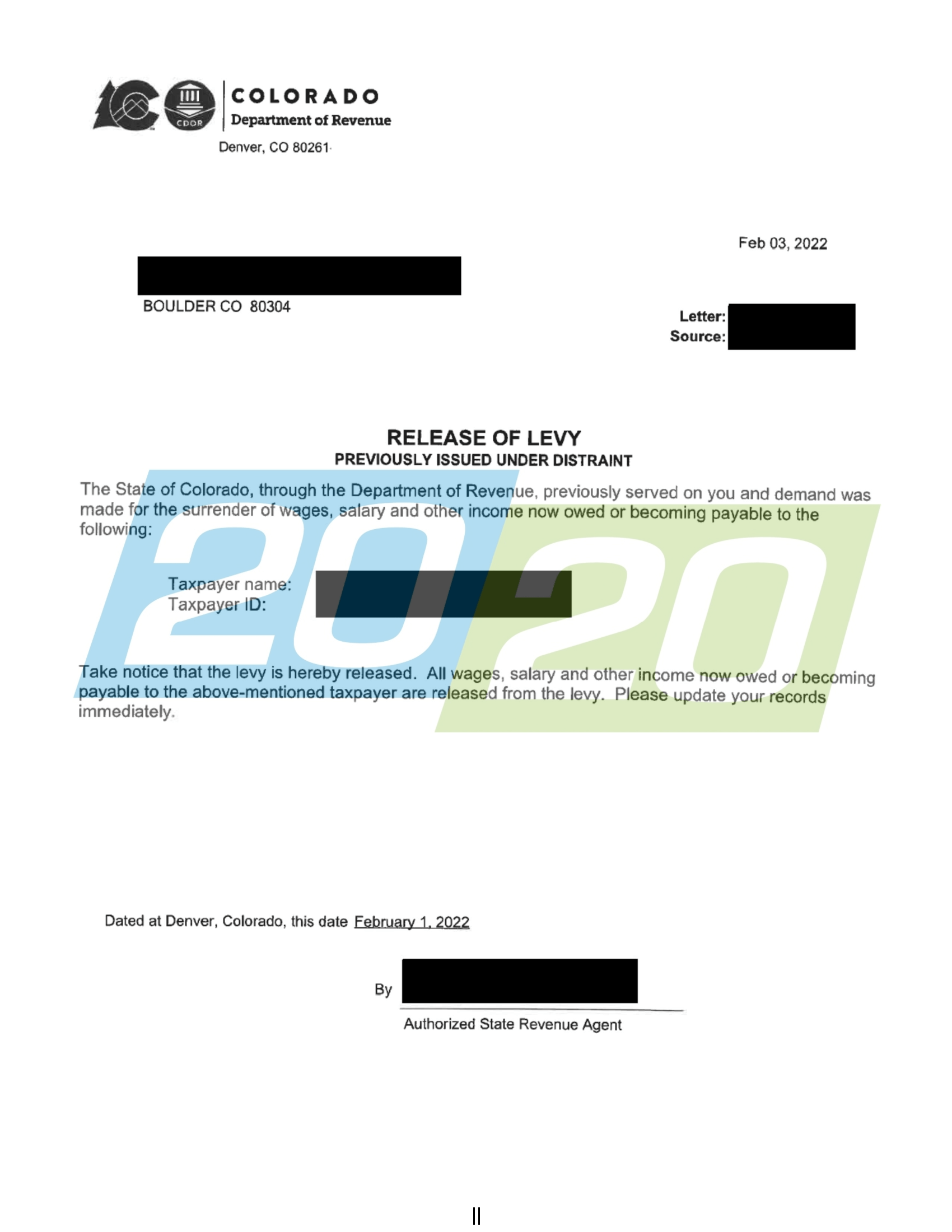

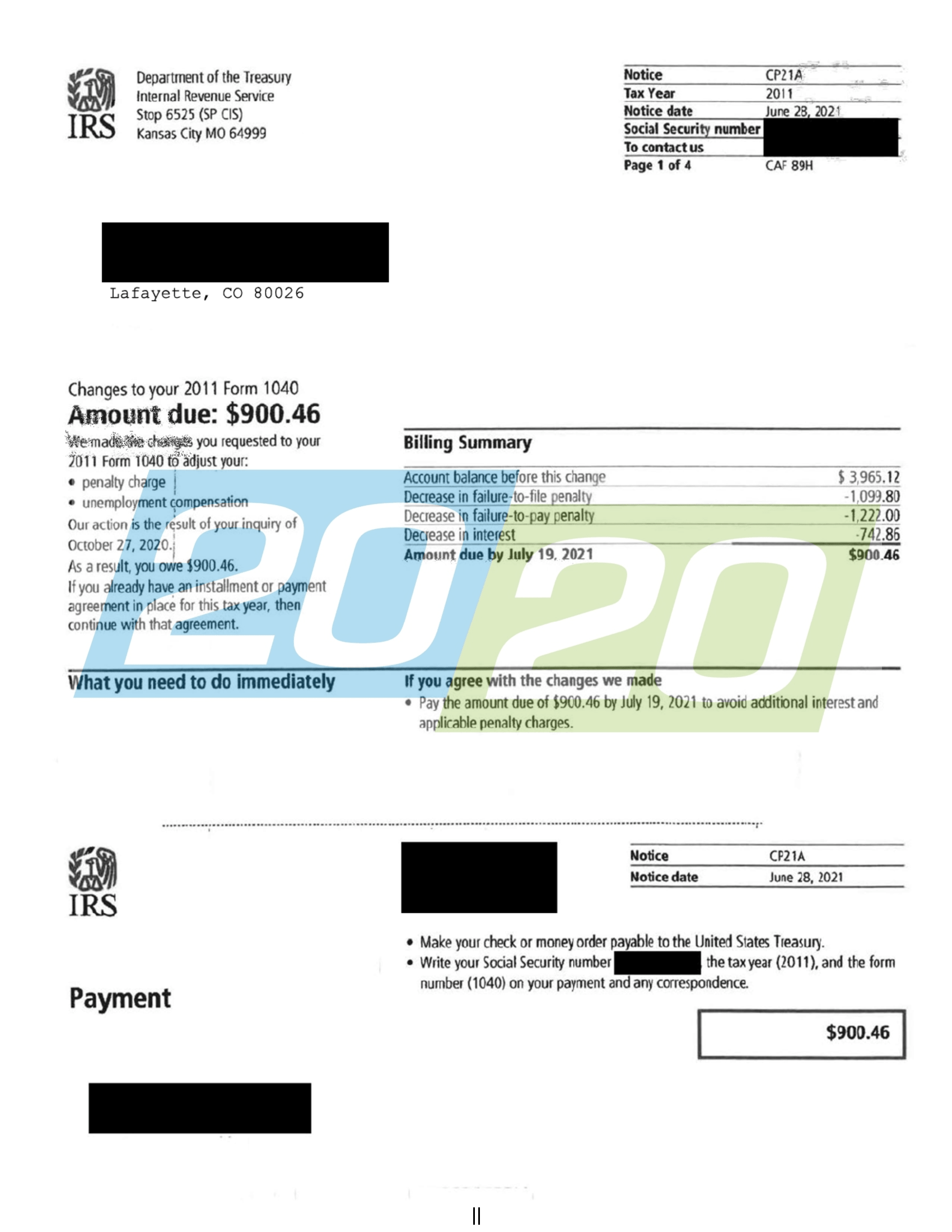

Tax Resolutions In Colorado 20 20 Tax Resolution

Tax Resolutions In Colorado 20 20 Tax Resolution

Colorado Sales Tax Rates By City County 2022

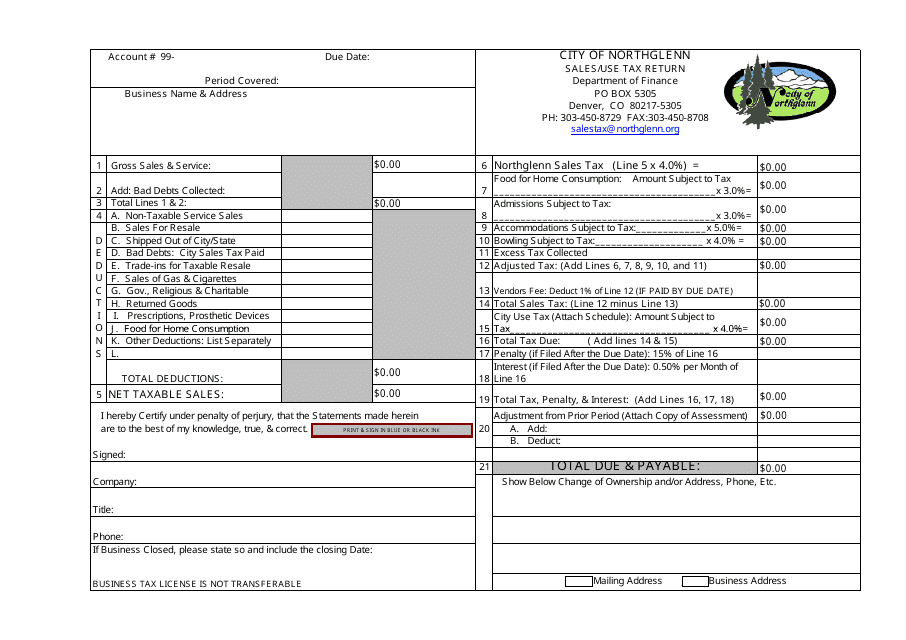

City Of Northglenn Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

Colorado Sales Tax Rates By City

Tax Resolutions In Colorado 20 20 Tax Resolution

Glenwood Springs Economic Boom Or Post Grand Avenue Bridge Detour Bump Postindependent Com

Tax Resolutions In Colorado 20 20 Tax Resolution

Breaking Down Glenwood Springs Lodging Tax Aspentimes Com

Economy In Glenwood Springs Colorado

Colorado State Tax Tables 2020 Us Icalculator

Where To File Sales Taxes For Colorado Home Rule Jurisdictions Taxjar

Tobacco Taxes Pass In Glenwood Springs And New Castle Postindependent Com

Glenwood Springs City Council Miffed By Lack Of Transparency In Pif Extension Plan News Aspendailynews Com

Economy In Glenwood Springs Colorado

Glenwood Springs Economy Is Strong As City Reports Sales Tax Collection Exceeded 2021 Forecast Aspentimes Com

Form Dr 0800 Fillable Location Jurisdiction Codes For Sales Tax Filing